SignRequest and LTO Network: electronic signatures secured by the blockchain

Over the last decade, there was a massive outburst of internet users across the globe. Simultaneously, there’s been a growing penetration of different digital and paperless technologies across businesses and organizations, especially in the area of electronic, digital signatures.

Going digital certainly bring endless benefits to any business like for e.g. process automation and optimization, better accessibility, better scalability, mitigating human errors, reducing costs, and a lot more. In fact, several government bodies across the globe have encouraged the digital push to bring better services to its people. Furthermore, digitization plays a pivotal role by helping government agencies to engage with the people in a meaningful and transparent manner.

Governments embracing digitization of processes

Last year in July 2018, the Los Angeles County Community Development Commission, the body that handles community development and redevelopment as well as housing, had adopted the digital route entirely while going paperless.

“The idea of a system like this is to take that tedious work away from the case manager like this to allow them to focus on the people they serve,” said Van Gelder, a veteran of government IT work.

Also, the Dubai government, that prefers to stay at the forefront of embracing new technological innovations pledges to eliminate paper-based transactions by 2021. Under the Smart Dubai Initiative, Dubai’s crown prince – Shaikh Hamdan Bin Mohammad Bin Rashid Al Maktoum – has asked his ministry to prepare for this transformation.

Similarly, the European country of Estonia has initiated concrete measures in modernizing its administration while moving towards becoming an e-government powerhouse.

Demand for cryptographic technologies like electronic signatures

While companies across the globe are taking active measures to automate and digitize processes, the two major cryptographic technologies that remain at the heart of this transformation are Electronic Signatures and Blockchain Technology.

However, moving towards digitized processes comes with its own set of challenges like authenticity, transparency, and security, and its better said than done. Thus before reaching out to consumers to use their services, businesses and government organizations need to ensure that the transformation is safe and smooth.

With the massive growth in the number of internet users, millions of digital documents are shared online every day. Thus, the demand for Electronic Signatures technology is on a steady rise to protect these files from malicious activities of forgery and document-tampering.

Ultimately, Electronic Signatures help to significantly reduce the administrative burden for the organizations while speeding up the entire process for the end consumer.

According to a recent research report, the Electronic Signatures market is expected to grow at 37% CAGR up to 2023. The Electronic Signatures market size which was USD 1.8 billion in 2018, is likely to reach 5.5 billion by 2023. There are several companies like SignRequest, DocuSign, PandaDoc, and other offering Digital Signature services.

Expanding eSignatures market by adding the security of the blockchain technology

The growth of the blockchain technology over the last decade makes it a potential contender for secure record-keeping of confidential and classified documents. The tamper-proof and immutable nature of the blockchain technology makes it the most preferred choice of implementation for the banking and other sectors.

The peer-to-peer transaction nature of blockchain reduces all the intermediaries while speeding up the entire process. Furthermore, the P2P nature of blockchain also helps to eliminate any security risks making the entire process stable and secure.

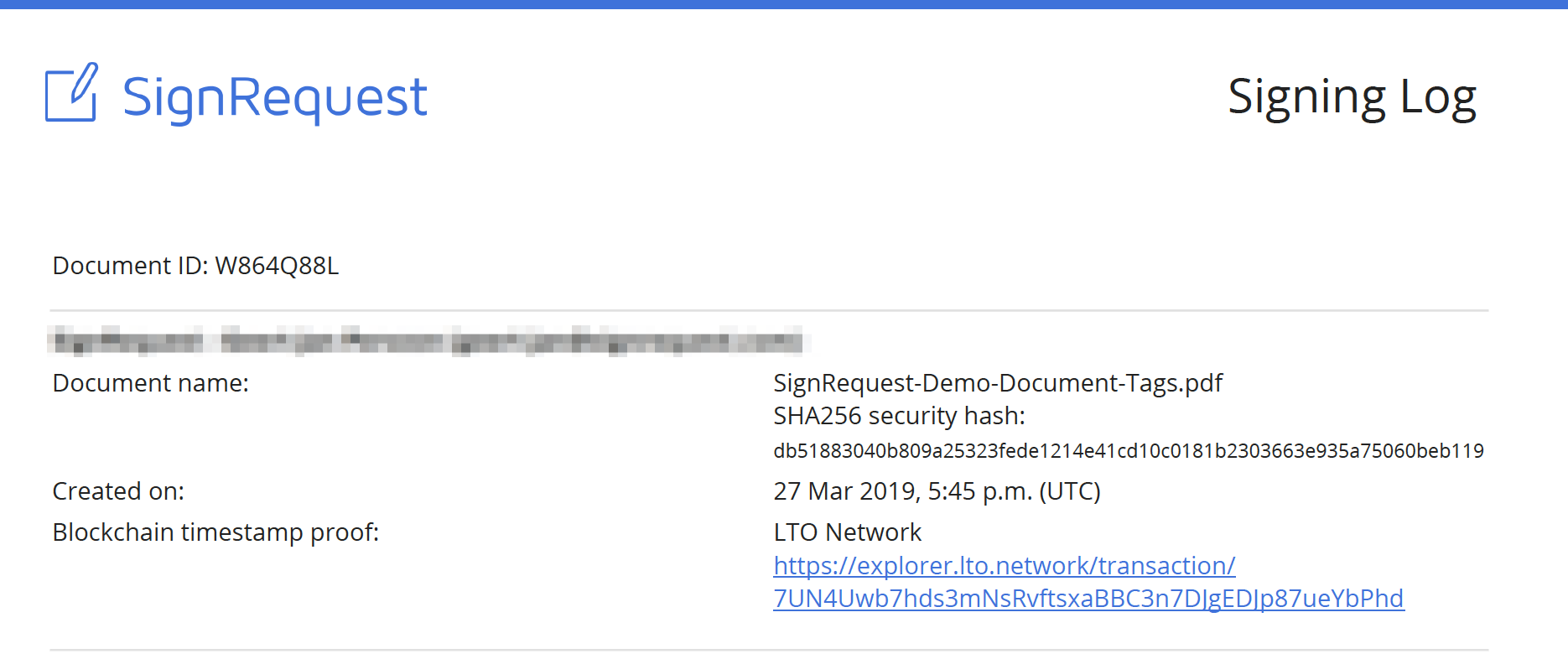

The latest example of these two cryptography technologies working together is the collaboration between the LTO Network with SignRequest. The partnership begins with the integration of LTO Network’s blockchain technology in SignRequest’s application – which is already live!

"SignRequest is a perfect example of a forward thinking company who sees the blockchain landscape and narrative maturing. Millions of transactions per year will immensely stimulate LTO Network’s usage and the trust in it"

Rick Schmitz, CEO of LTO Network

Apart from being fully decentralized, the LTO Network’s Blockchain infrastructure provides better scalability solution while offering seamless integration with the existing systems. Hence, they take care of two major issues of public blockchain network i.e. scalability and the ability to integrate with the existing systems thereby making it useful to businesses and government organizations. Also, by leveraging the hybrid infrastructure, the LTO Network takes care of the GDPR regulatory rules.

“Using the blockchain for Proof-of-Existence for electronic signatures just makes sense and is already happening. When we researched blockchain platforms, LTO Network stood out in terms of speed, set-up, and capabilities. We are able to include the blockchain transaction identifier directly into our signing logs which are circulated upon signing without the need to wait minutes for confirmations. Next to that, the potential of creating decentralized workflows did the trick to add the LTO Network solution as an option to our users.”

Michaël Krens, CTO of SignRequest

Both – the blockchain technology and Electronic Signatures – find its applications in a number of sectors like healthcare, education, banking, insurance, and other financial services, real estate, logistics, manufacturing and engineering, and many others.

These two technologies help to streamline the entire documentation process of customers while simultaneously ensuring a better record-keeping facility in place. Here’s an example of how these two technologies are playing a crucial role in India’s digital lending sector.

India, which is currently the world’s fastest-growing economy, is a major participant of the ongoing FinTech revolution. The latest report from The Indian Express notes that there’s an exponential growth of the country’s digital lending market.

Several P2P platforms are working in coordination with India’s central bank for the effective disbursement of loans to the micro, small and medium enterprises (MSMEs). With the robust infrastructure for Electronic Signatures and Blockchain in place, India’s digital lending industry is now helping companies to realize their entrepreneurial dreams.

According to the India Fintech report 2019, there are a total of 338 lending platforms will more players coming to the market, as there is a huge untapped lending opportunity for them. Manav Jeet, the founder of online lending firm Rubique, said, “A few years ago, the concept of ‘online loan’ in India was confined to information search only. But the scenario has changed now and people are moving towards a transaction with complete digital and paperless journey available in this space.”

- Try out the free demo of SignRequest and the blockchain product.

- See other integrations of LTO Network’s technology and explorer.

News Bitcoin | AmbCrypto | Yahoo Finance | The Merkle | Investing.com